Investment Strategy and Evolution Analysis on Value-Added Service of Logistics Information Platform

-

摘要: 为了提高物流信息平台的竞争优势,考虑平台主体之间演化关系,探讨了物流信息平台增值服务投资策略问题. 首先,分析不同增值服务投资策略下的用户行为与特征,建立用户效用函数和平台利润函数;其次,构建基于Hotelling模型的竞争性物流信息平台增值服务投资定价模型,探讨了双边单归属与单边多归属两种情形下平台增值服务的最优投资策略;最后,基于平台增值服务最优投资策略构建平台主体决策行为的演化博弈收益矩阵,分析物流信息平台双方投资演化行为,获得平台增值服务投资的演化均衡策略. 研究结果表明:双边用户单归属下,当增值服务单位投资成本在一定阈值内时,两个平台采取相同的投资策略;当增值服务投资单位成本不在该阈值内时,单个平台采取投资策略或两个平台采取投资策略;单边用户多归属下,两个平台采取相同的投资策略.Abstract: In order to improve the competitive advantage of logistics information platform, in view of the evolutionary relationship, the investment strategy of the value-added service offered by the platform is explored. Firstly, the user utility function and platform profit function are established by analyzing the user behavior features under difference strategies. Secondly, the investment pricing model of the value-added service is constructed based on Hotelling model, and the optimal investment strategy of the value-added service under two different user attribution situations is discussed, i.e. two-sided market and single-homing users, and single-sided market and multi-homing users. Finally, the evolutionary game income matrix based on the optimal investment strategy is constructed to analyze the evolutionary investment behavior of both sides of the logistics information platform, and the evolutionary equilibrium strategy is obtained. The results show that, when the users are single-homing and the investment cost is within a certain threshold, the two platforms adopt the same investment strategy; when the investment cost is not within the threshold, single platform or two platforms adopt the strategy. When there is a one-sided market and muti-homing users, the two platforms adopt the same investment strategy.

-

Key words:

- two-sided market /

- muti-homing /

- logistics information platform /

- evolutionary game

-

表 1 变量说明

Table 1. Variables

变量 含义 i 平台 i ( i = 1,2) v 基本价值 αb (αs) 货主(车主)的交叉网络外部性系数 λ 匹配到车的概率 m 找车次数 nb,i (ns,i ) 平台 i 上货主(车主)用户规模 pb,i (ps,i ) 平台 i 对货主(车主)定价 $p_{ {\rm{b} },i}^*{\simfont\text{(} }p_{ {\rm{s} },i}^*{\simfont\text{)} }$ 平台 i 上货主(车主)的最优定价 $\theta_{\rm{v} }{\simfont\text{(} }\theta_{\rm{g} }{\simfont\text{)} }$ 找车(找货)机会成本 ${\eta _{ {\rm{v} },i} }{\simfont\text{(} }{\eta _{ {\rm{g} },i} }{\simfont\text{)} }$ 不在平台 i 上找车(找货)难易程度 ki 平台 i 增值服务投资量 $k_i^* $ 平台 i 的增值服务最优投资量 β 增值服务产生的效用 c 投资增值服务的单位成本 Ub,i (Us,i ) 平台 i 上货主(车主)效用 P i,(e, g) 平台 i 采取(e, g)策略时平台 i 的利润,

(e, g∈{I,N})$P_{i,(e,g)}^*$ 平台 i 采取(e, g)策略时平台 i 的最优利润 $ P_i $ 平台 i 的利润 表 2 双边单归属下平台1和平台2的收益矩阵

Table 2. Income matrix for platform 1 and 2 under two-sided market and single-homing users

平台 1 平台 2 投资 不投资 投资 $\left( {P_{1,({\rm{I,I} })}^*{\rm{, } }\;P_{2,({\rm{I,I} })}^*} \right)$ $\left( {P_{1,({\rm{I,N} })}^*{\rm{, } }\;P_{2,({\rm{I,N} })}^*} \right)$ 不投资 $\left( {P_{1,({\rm{N,I} })}^*{\rm{, } }\;P_{2,({\rm{N,I} })}^*} \right)$ $\left( {P_{1,({\rm{N,N} })}^*{\rm{, } }\;P_{2,({\rm{N,N} })}^*} \right)$ 表 3 双边单归属下均衡点的局部稳定性检验

Table 3. Local stability test of equilibrium points under two-sided market and single-homing users

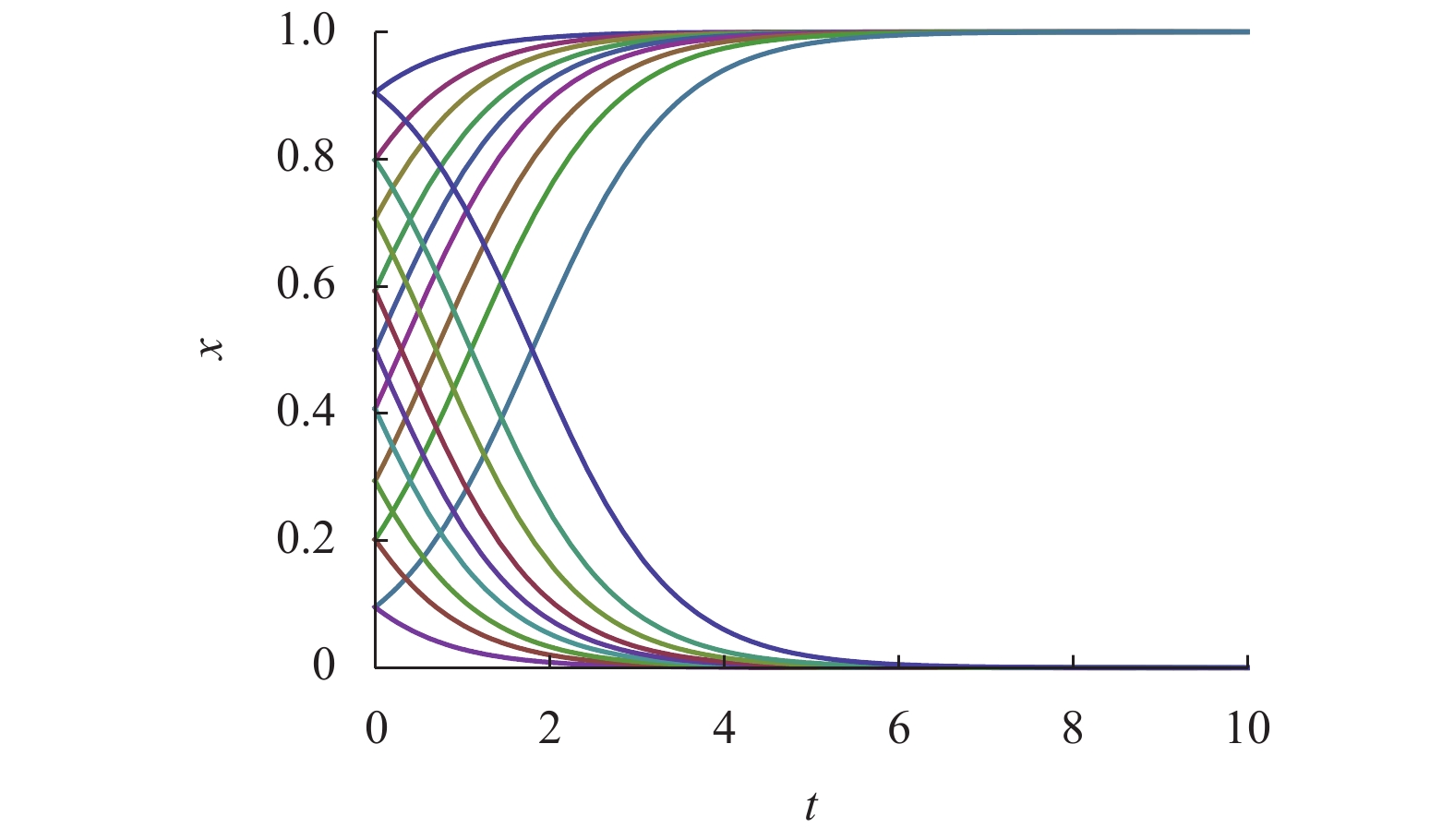

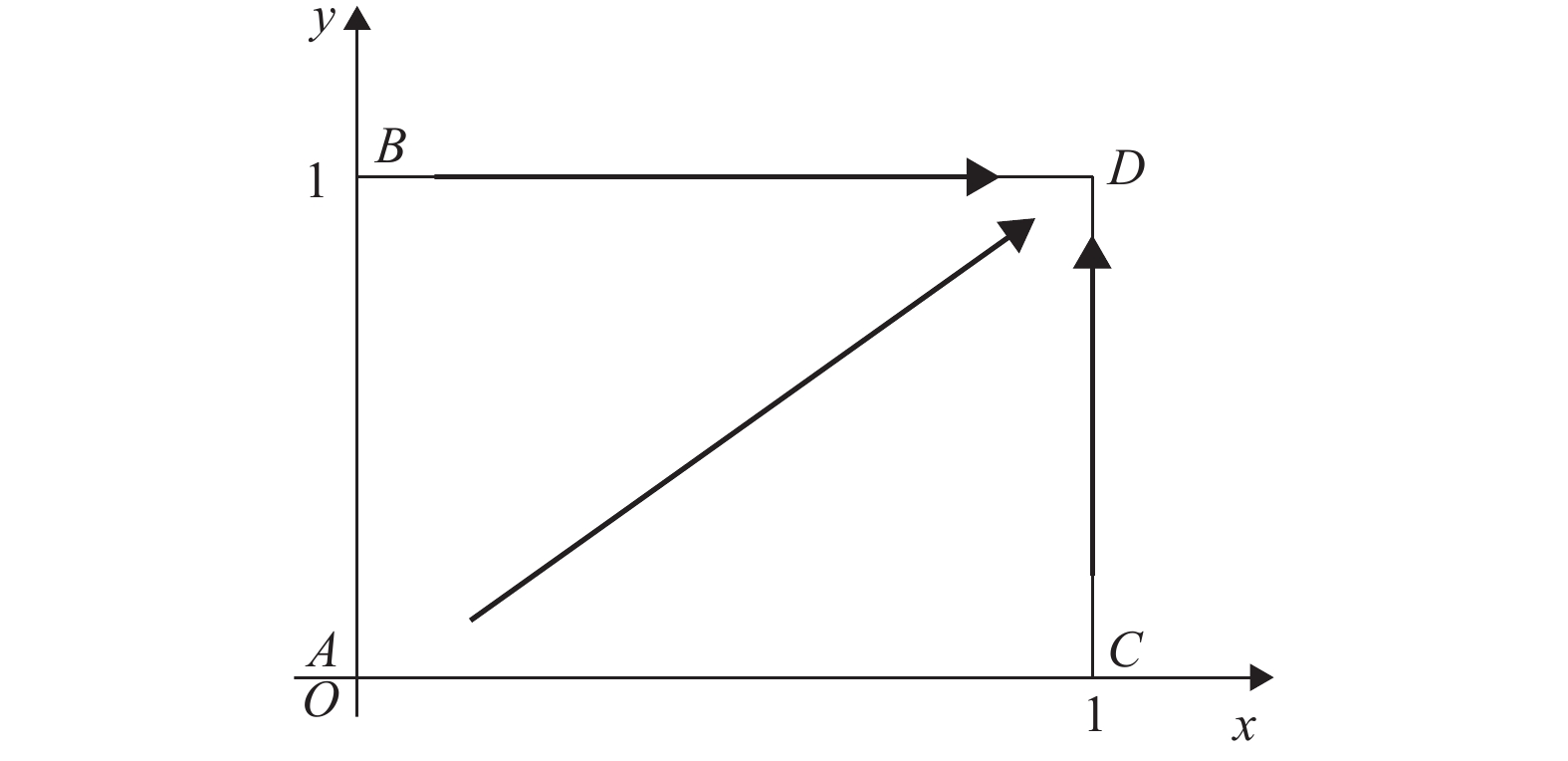

情形 条件 均衡点 Det J Tr J 稳定性判别 S1 $0 < c < H$ A + − ESS B + + 不稳定点 C + + 不稳定点 D + − ESS E ? 0 鞍点 S2 $H < c$ A + + 不稳定点 B + − ESS C + − ESS D + − ESS E ? 0 鞍点 表 4 单边多归属下平台的收益矩阵

Table 4. Income matrix for platform under single-sided market and multi-homing users

平台 1 平台 2 投资 不投资 投资 $\left( {P_{1,({\rm{I,I} })}^*{\rm{, } }\;P_{2,({\rm{I,I} })}^*} \right)$ $\left( {P_{1,({\rm{I,N} })}^*{\rm{, } }\;P_{2,({\rm{I,N} })}^*} \right)$ 不投资 $\left( {P_{1,({\rm{N,I} })}^*{\rm{ ,} }\;P_{2,({\rm{N,I} })}^*} \right)$ $\left( {P_{1,({\rm{N,N} })}^*{\rm{, } }\;P_{2,({\rm{N,N} })}^*} \right)$ 表 5 单边多归属均衡点的局部稳定性检验

Table 5. Local stability test of equilibrium points under single-sided market and multi-homing users

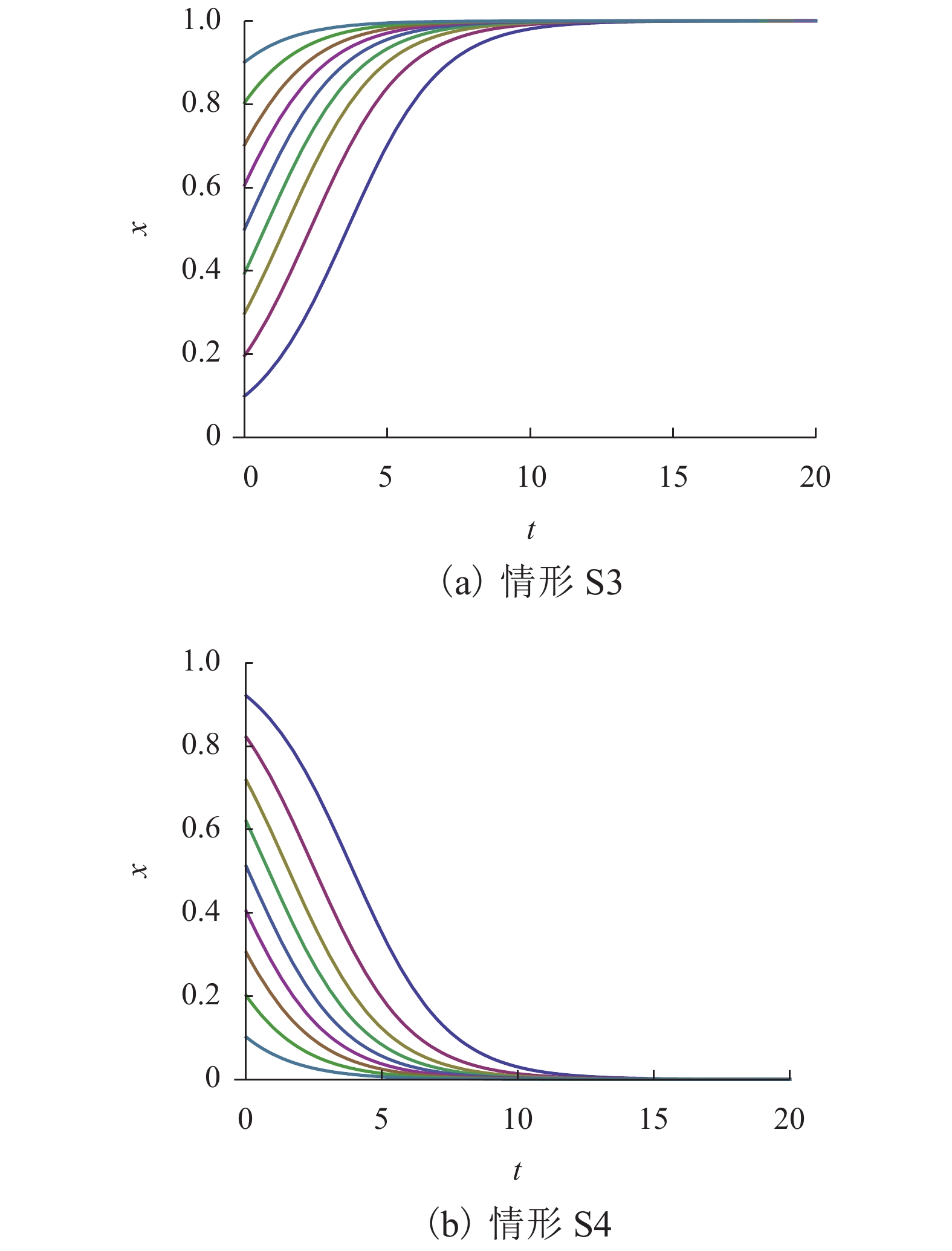

情形 条件 均衡点 Det J Tr J 稳定性判别 S3 $G > 0$ A + + 不稳定点 B + + 不稳定点 C + + 不稳定点 D + − ESS E ? 0 鞍点 S4 $G < 0$ A + − ESS B − ? 鞍点 C − ? 鞍点 D + + 不稳定点 E ? 0 鞍点 -

ARMSTRONG M. Competition in two-sided markets[J]. Rand Journal of Economics, 2010, 37(3): 668-691. ROCHET J C, TIROLE J. Two-sided markets:a progress report[J]. Rand Journal of Economics, 2006, 37(3): 645-667. doi: 10.1111/j.1756-2171.2006.tb00036.x HAGIU A. Pricing and commitment by two-sided platforms[J]. The RAND Journal of Economics, 2006, 37(3): 720-737. doi: 10.1111/j.1756-2171.2006.tb00039.x 徐兵,朱道立. 具有网络外部性的扩展Hotelling模型[J]. 管理科学学报,2007,10(1): 9-17.XU Bing, ZHU Daoli. Extended Hotelling model with network externality[J]. Journal of Management Sciences in China, 2007, 10(1): 9-17. 张凯,李华琛,刘维奇. 双边市场中用户满意度与平台战略的选择[J]. 管理科学学报,2017,20(6): 42-63.ZHANG Kai, LI Huachen, LIU Weiqi. Competition in two-sided platforms considering agent's satisfaction[J]. Journal of Management Sciences in China, 2017, 20(6): 42-63. CHU J, MANCHANDA P. Quantifying cross and direct network effects in online consumer-to-consumer platforms[J]. Marketing Science, 2016, 35(6): 870-893. doi: 10.1287/mksc.2016.0976 RAUL B B, MARKUS K. Armstrong meets Rochet-Tirole:on the equivalence of different pricing structures in two-sided markets[J]. Economics Letters, 2019, 177(4): 43-46. PAUL B, MARTIN P. Platform competition and seller investment incentives[J]. European Economic Review, 2010, 54(8): 1059-1076. doi: 10.1016/j.euroecorev.2010.03.001 HAGIU A, SPULBER D. First-party content and coordination in two-sided markets[J]. Management Science, 2013, 59(4): 933-949. doi: 10.1287/mnsc.1120.1577 REN S, SCHAAR M V D. Pricing and investment for online TV content platforms[J]. IEEE Transactions on Multimedia, 2012, 14(6): 1566-1578. doi: 10.1109/TMM.2012.2217120 豆国威. 双边平台增值服务的投资和定价策略研究[D]. 合肥: 中国科学技术大学, 2016. 桂云苗,武众,龚本刚. 竞争环境下B2C平台增值服务投资决策[J]. 控制与决策,2019,34(2): 395-405.GUI Yunmiao, WU Zhong, GONG Bengang. Value-added service investment decision of B2C platform in competition[J]. Control and Decision, 2019, 34(2): 395-405. -

下载:

下载: